Blog

Preparing to Sell Your Practice

The vast majority of today’s independent advisors only consider the option of selling to a third-party when it is time to retire or significantly throttle back as a last resort. Many advisors prefer a path with internal successors that allows them to exit gradually while building a strong, sustainable business. Many of these same advisors, however, come to realize too late that that process takes a fair amount of time, skillful execution, and next generation talent. As a result, a third choice emerges: that of attrition, which for most advisors is less of a choice and more of a default–keep working, enjoy the income, and let the practice slowly wind down if no better option emerges.

Attrition, however, involves a gradual drop off of clients, revenue, and value. It does not consider the future of all of the clients who have relied on their advisor for years. To avoid attrition, advisors should consider a sale to a third-party and exit in a professional and contemplative manner before any value is lost and clients are left to find a new advisor on their own. The brief exploration that follows can help to remove some of the mystery and many of the myths around the exit planning process and make it a higher priority choice.

This external sale process is one of several “exit plan” paths, but it is often the best (and most lucrative) choice for certain advisory businesses–especially those who are otherwise facing attrition. Selling your practice to a third-party is the fastest of all the exit strategies, and something to consider depending on the circumstances and your needs. In most cases an external sale can produce a more liquid transaction with substantial, non-refundable down payments of 30% to 80% of the selling practice’s value. In the current sellers’ market, obtaining fair market value on very competitive terms is well within reach of the average selling practice owner. Setting up a practical and successful exit plan is about structuring a deal that works well for everyone.

Where to Start

Finding an interested buyer isn’t hard. It’s finding a qualified buyer that’s the challenge. Elevated and specific qualifications must be met by a buyer in order to achieve the goal of satisfying the underlying client base and the supporting staff members. Realizing fair market value also requires a motivated and capable partner. A common starting place for most sellers includes consideration of a buyer’s:

- Investment philosophy

- Regulatory structure

- Enterprise strength

- Experience, education, and credentials

- Technology level

- Complimentary or additive services and benefits

Ultimately, the buyer might end up being one of your friends, a peer, a competitor, a consolidator or aggregator, a bank or a credit union, or even a CPA firm, but they still need to check off the basic requirements. A further challenge lies in not just finding a qualified buyer, but in finding a great buyer–the perfect advisory firm to take over, pay market value, and retain all of the clients.

In most cases, independent financial advisors have very little experience in selling what they’ve built–they’ll only do this once. While it is OK to have little experience in the process, having little knowledge can be a real problem. To this end, it is not unusual for prospective sellers to embrace the first buyer or offer that comes along and take what they can get. This is almost always a mistake.

It is understood that in a highly regulated, relationship-based, professional services business model, most independent advisors cannot risk putting a “FOR SALE” sign out front or spreading the word through a group of peers and hoping for the best. Starting and ending with a 1:1 buyer to seller ratio may seem quicker, but it puts the buyer in almost total control. There is a better way to find the best match and obtain full value, while taking proper care of the trusting client base and their support staff.

The good news is that there exists an open-market, competitive system in which to find the best buyer, all while maintaining a seller’s confidentiality. With an average 50:1 buyer to seller ratio, sellers can afford to be particular–and they need to be. Think of the process as an audition in which each buyer puts their best foot forward and explains why they should make it to the next level of consideration.

Finding the Best Match

The open market process helps make it possible for an independent advisor to find his or her best match from a large pool of applicants in a confidential and controlled manner. The high buyer to seller ratio allows an advisor to act in his or her clients’ best interests by providing a hand-picked replacement of equal or better quality. When it comes time to exit the business, every independent advisor has a duty to find the best possible replacement. To this end, our advice has been consistent for the past twenty years:

- Focus first on finding the best operational and cultural match between buyer and seller.

- Second, focus on the issue of “geography.” Sometimes this means selecting a buyer who is close by, and sometimes it doesn’t.

- After satisfactorily resolving the first two issues, then and only then focus on price and terms.

Most advisors readily accept the concept of “best match” but often default to looking towards a friend, a colleague, or someone recommended by their broker-dealer, for the easy answer. There is nothing wrong with selling to a friend. You might sell your home to a friend too, but would you forgo knowing what the market value actually is, and what the standard deal terms are? Would you give up tax benefits and self-finance a large portion of the price because it seems easier and more convenient? There are almost always better alternatives–for you and your clients–if you take the time to fully explore the possibilities.

Timing Your Sale

Timing the “end game strategy” is an inexact science; there is no perfect formula or answer. If you were to treat your financial practice like your house or a significant stock holding, selling on the way up makes the most sense–though that trajectory is hard to judge but in hindsight. Other than picking a time that seems right to you given your age, your levels of energy and enthusiasm, the time of year or the time of life, there are some other general guidelines that past sellers have used and found helpful.

For starters, it is important to understand that the period from listing to sale often takes place in less than 120 days or so, but the period from closing the transaction to locking in any final purchase price and payment contingencies is usually around one year (post closing). If you want to be completely done with the process and see all contingencies expire while you’re fully engaged in the transition process to make the best of the situation, you should get started about one year earlier than you might otherwise.

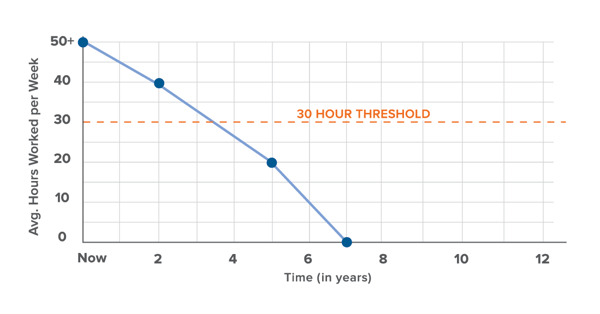

Another helpful exercise is to lay out your own “work week trajectory.” In other words, instead of focusing on how much money you need from the sale, when the equity markets might have peaked, or when you’re ready to pursue some new interest or livelihood, look instead to something much simpler and closer to home. Forecast the amount of time you would like to spend working in your practice in the years to come. Realistically, what would you like to do? Use a graph like the one below to plot your own work week trajectory. The example provided here (click to enlarge) is one advisor’s preference to completely retire in seven years, gradually reducing the hours he spent working in the practice along the way.

Note the horizontal line at the 30-hour per week level as illustrated. This line represents, the “30-hour threshold” and provides an important lesson for founders and exit planners: there are more ways to shift or relinquish control of a professional practice or a business than selling it outright. Few highly-regulated practices can operate efficiently with the founder and primary rainmaker consistently working less than 30 hours a week, or less than about three-fifths of peak efforts. In time, as younger competitors work hard to build their practices and continually invest time and energy, older advisory practices with just one owner working less than full time (even with a lot of experience and know-how) will begin to slip and lose value and clients.

Advisors should start the formal exit planning process 3 to 5 years before they anticipate breaking the 30-hour threshold. Start by obtaining a formal, market-based valuation that looks at what you’ve built from the eyes of a buyer and start tracking your equity value on an annual basis. Also consider that the right buyer will gladly accommodate a seller who wants to retire a little more gradually through a Sell and Stay™ path.

Letting Go

It isn’t easy to be an independent advisor relying on your own abilities to survive and prosper year after year. Entrepreneurs are unique and intrepid people who just aren’t wired to quit. But being independent (and human) means exactly that: at some point you’ll have to. Someday, someone is going to have to take over for you. Exit planning, including selling what you’ve built, is the process of taking control over to whom, when, and how you are succeeded.

For most advisors, the work they do and the practices they’ve built represent the single, largest, most valuable asset they own. Yet this asset is closely-held, and fragile. Most financial practices rely almost entirely on one key advisor. If something happens to that advisor, the value can be lost in a heartbeat. Managing the exit strategy isn’t just a goal, it is an absolute necessity. And this perspective doesn’t even begin to take the clients’ needs and expectations, nor the staff’s, into account.

Doing nothing–the attrition route–can be a plan too, but it is a self-serving plan. Selling what you’ve built to a hand-picked buyer and then shepherding the clients into the waiting arms of the new team takes work. Finishing the job is one of the responsibilities of independent ownership.

Just remember – it is okay to leave. You’ve earned it.

At FP Transitions, we take a multi-disciplinary approach to establishing, protecting, growing and transitioning your business. Over time, your goals will shift, and we're here for that, too. Ultimately, the decision to sell your advisory firm will come down to your priorities and goals. We see ourselves as your partner, helping you establish healthy options and reflect upon next steps. Our consultative approach keeps you in the driver's seat.

Ready to talk about your business?

/Preparing%20to%20Sell%20Your%20Practice.png?width=631&height=210&name=Preparing%20to%20Sell%20Your%20Practice.png)