Blog

Plotting Your Exit

When should you start developing your exit plan or succession plan?

The short answer is: start the planning process early. Successful internal succession planning can be a 10- to 15-year process so give yourself adequate time. For advisors who want to sell externally, the planning process should start three to five years before you think you’re ready to actually sell.

Projecting an Off Ramp

As you forecast your exit timeline it’s important to consider factors like cash flow and how much will be required to move into retirement and maintain your desired lifestyle. You should also consider how long it will take to put your successor team in place and when you’ll be able to hand over the reins completely.

One of the best ways to make a timeline projection is to determine how much time you want to—or will realistically be able to—spend productively working in the office, and create a “workweek trajectory.”

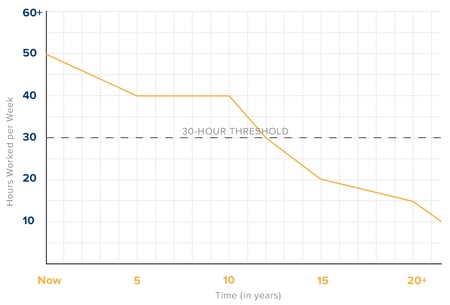

Use a graph like the one below to plot your own workweek trajectory. You can download and print your own blank graph here.

Start with an accurate assessment of the average number of hours you currently spend in the office each week and how many you spend diligently working from home. Next, plot how many hours you’d like to be working in two, five, eight, and ten years from now (you can use narrower or wider time gaps to fit your fact pattern).

This example illustrates one advisor’s preference to leverage junior advisors on his team and transition ownership to them as she retires gradually. Click here to download a blank Workweek Trajectory chart.

Mapping out your workweek trajectory not only pinpoints your exit, it helps you forecast your timeline and determine your planning targets. This will allow you to make more informed business decisions like investing in various growth strategies, evaluating staff levels, and determining compensation.

The 30-Hour Threshold

The line at the 30-hour-per-week level in the graph above represents the “30-hour threshold.” The 30-hour threshold is important for founders and exit planners to know as very few practices can operate efficiently when the founder and primary rainmaker consistently works fewer than 30 hours per week.

In time, advisory practices with just one owner who works less than full time, despite having years of experience, eventually begin to deteriorate. The client demographics become less diverse, growth rates decline, and fewer new clients come through the door. The practice soon finds itself in attrition mode.

The point where your own workweek trajectory crosses the 30-hour threshold indicates the deadline for you to have your succession plan or sale strategy poised to execute—if not already executed. Using this intersection as an important milestone in your planning process allows you to protect business value and to carry out your preferred transition on your own terms.

The Longer Answer

So, when should I start developing my exit plan and what do I need to do?

Advisors who want to transition their businesses externally should start developing their exit plans three to five years before they pass the 30-hour threshold.

- Carefully monitor value annually and correlate any effect on value with the declining workweek trajectory.

- Determine what your external transition will look like: a one-and-done sale, a Sell and Stay® path, or a merger that accommodates your exit timeline.

- Investigate what those journeys will take and create the action items you’ll need to execute to achieve that goal.

- Work backwards to predetermine triggers in your monitoring that indicate your 30-hour threshold is approaching.

An internal transition designed to perpetuate income as you slow down and avoid a “hard stop” takes longer to plan. In order to execute a successful internal transition, you must have successors and key business structures in place. Getting these elements established can take a significant amount of time and will elongate the projected timeline for executing your plan. Start laying the appropriate foundations and formalizing your internal succession plan as soon as possible.

- Identify key team members.

- Determine increments of ownership transfer and length of tranches.

- Establish a compensation structure to facilitate successor buy-in with profit distributions.

- Establish appropriate operational and entity structures to support multi-generational ownership.

Most advisors who prefer the internal succession path start ten years too late. We see many owners initiating the planning process around the age of 60. While this might not always be too late to design and implement a successful plan, it eliminates room for plan adjustments or unexpected course corrections. The longer you wait to plan the fewer options you have.

The Unpredictable Future

Timing an “endgame strategy” is hard. There is no perfect answer or scientific method for pinpointing the right year or the right time. Be aware of this and create periodic checkpoints and action steps that allow you to make informed adjustments to your trajectory as needed. The trajectory worksheet is one of several tools that will help you hone in on your exit timeline, plan for it, and maximize the value realized for the business you’ve built.