Blog

Six Steps to Creating An Effective Continuity Plan

The single, biggest threat to an independent advisory practice is not the lack of a succession or exit plan, it is the lack of a plan to protect client interests and business value in the event of an owner’s sudden death or disability. And still, relatively few practice owners have implemented a reliable continuity plan.

As you put together your own unique plan, here are six best practices to consider as you create an effective and practical continuity plan:

-

Put your plan in writing. Create a concise, clearly-written continuity plan so that it works under adverse circumstances, without your ongoing involvement.

-

Use an industry-specific valuation for market value in a transition to a third-party buyer or external continuity partner, or an equity-based valuation for equity ownership interests as is common with internal continuity partners. For situations like death or disability, it is important to quickly, and accurately determine value. Be sure the determined value comes from a credible, third-party opinion with the database and accreditation to support the result.

-

Update your buy-sell agreement and valuation on an annual basis. As your business grows, you’ll want to capture current value and deal terms that support an agreed upon purchase amount. A routine review of the agreement can help practice owners ensure that their document addresses changes in circumstances and provides for evolution of the plan.

-

Carefully and clearly define the term “disability” in your continuity agreement. Many practice and business owners allow boilerplate language to define when an owner is disabled and must be forced to sell. The reality is most disability cases are not caused by something sudden or catastrophic. They are more often caused by things like a health issue that starts and stops unpredictably over time, or by the medical condition of an advisor’s spouse or child that significantly alters their involvement and effectiveness on the job. Study the definition in your agreement carefully and make sure it fits the circumstances of your profession, your practice, and your life.

-

If you are a partner in a multi-owner business, make sure that your continuity agreement addresses what happens in the event of the involuntary departure of any one of the partners or shareholders. Draft these considerations as early as possible, while everyone is getting along and these issues are just theoretical.

-

Additionally, If you are a partner in a multi-owner business, be mindful when two or more senior owners are of similar age. An internal buy-out arrangement can require as many as seven to ten years (or more) from start to finish. This makes the process impractical for a single remaining owner in their late 50’s or early 60’s. One commonly used solution is to set up an internal ownership track. This provides an opportunity for the next generation to step in on a continuity basis and purchase the exiting owner’s shares or interest, as opposed to the business redeeming the equity interest of the departing owner.

No one wants to believe that the association with clients, business partners, or shareholders will someday come to an end, but it is important to accept that, one way or another, you will part ways. It is essential to plan for such events well in advance.

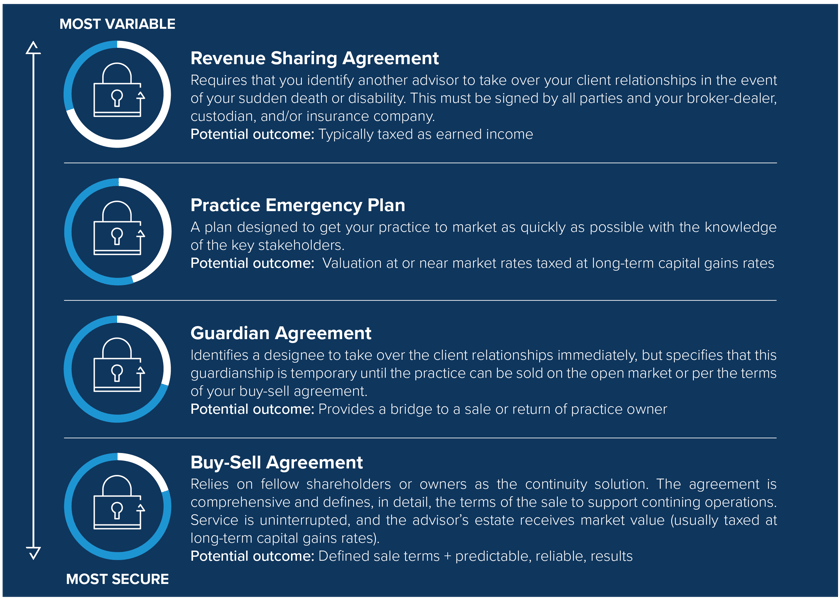

LEVELS OF CONTINUITY

There are a variety of continuity solutions available to address and protect clients, cash flow, operations, and value. Choosing the right one depends on the size and sophistication of the practice.

Revenue Sharing Agreements

The most common continuity solution for a single-owner practice derives from the most commonly used compensation structure: a revenue sharing arrangement. Independent broker-dealers and custodians routinely hand out short-form contracts to their advisors as a simple substitute for a formal or more comprehensive continuity plan. These agreements allow a seller and a buyer (or continuity partner) to agree ahead of time on terms of sale or transfer in the event of an advisor’s death, permanent disability, or sudden retirement. However, these agreements usually aren’t comprehensive, and provide minimal continuity as the entire client base and the existing owner’s estate typically receives only a percentage of the full market value.

Guardian Agreements

Continuity plans should account for the possibility of a temporary change in operating control or delivery of services. This situation might occur, for example, when an advisor is injured in an auto accident and is unable to work for five to six months, but eventually returns to the business. In this case, a guardian agreement identifies a designee to take over the client relationships immediately, but specifies that this guardianship is temporary until the owner can return to work or the practice can be sold on the open market.

Buy-Sell Agreements

These agreements identify a partner or employee as the chosen buyer of the practice at the outset. It is comprehensive and defines the terms of the sale and continued operation. The goals are to provide payment of fair market value to that individual or to their estate, to preserve client service, and to secure the business enterprise. if you have built–or are in the process of building–a multi-owner, multi-generational business, your continuity plan will logically derive from your formal succession plan.

Independent financial practices are among the most valuable professional service models in the U.S. But these practices are often built around the skill sets and personalities of individual advisors/owners, making their businesses’ value vulnerable. Ultimately, your clients are counting on you to establish a comprehensive continuity plan to protect their interests–along with you own practice value–for years to come.