Completing a formal valuation is step one. Step two is securing that value with a continuity plan.

Having a formal, written continuity plan in place for the unexpected exit of an owner–especially if they’re the only owner–is paramount to ensure your practice and its clients are protected.

Annually updating the plan is just as important as the signatures on the document itself. Your plan and contingencies must evolve along with your business. An up-to-date and accurate agreement will prevent confusion in an already emotional and chaotic situation should the plan need to be implemented. Each year you must account for any business growth (or decline) as well as changes in compensation, personnel, client base, and other practice details.

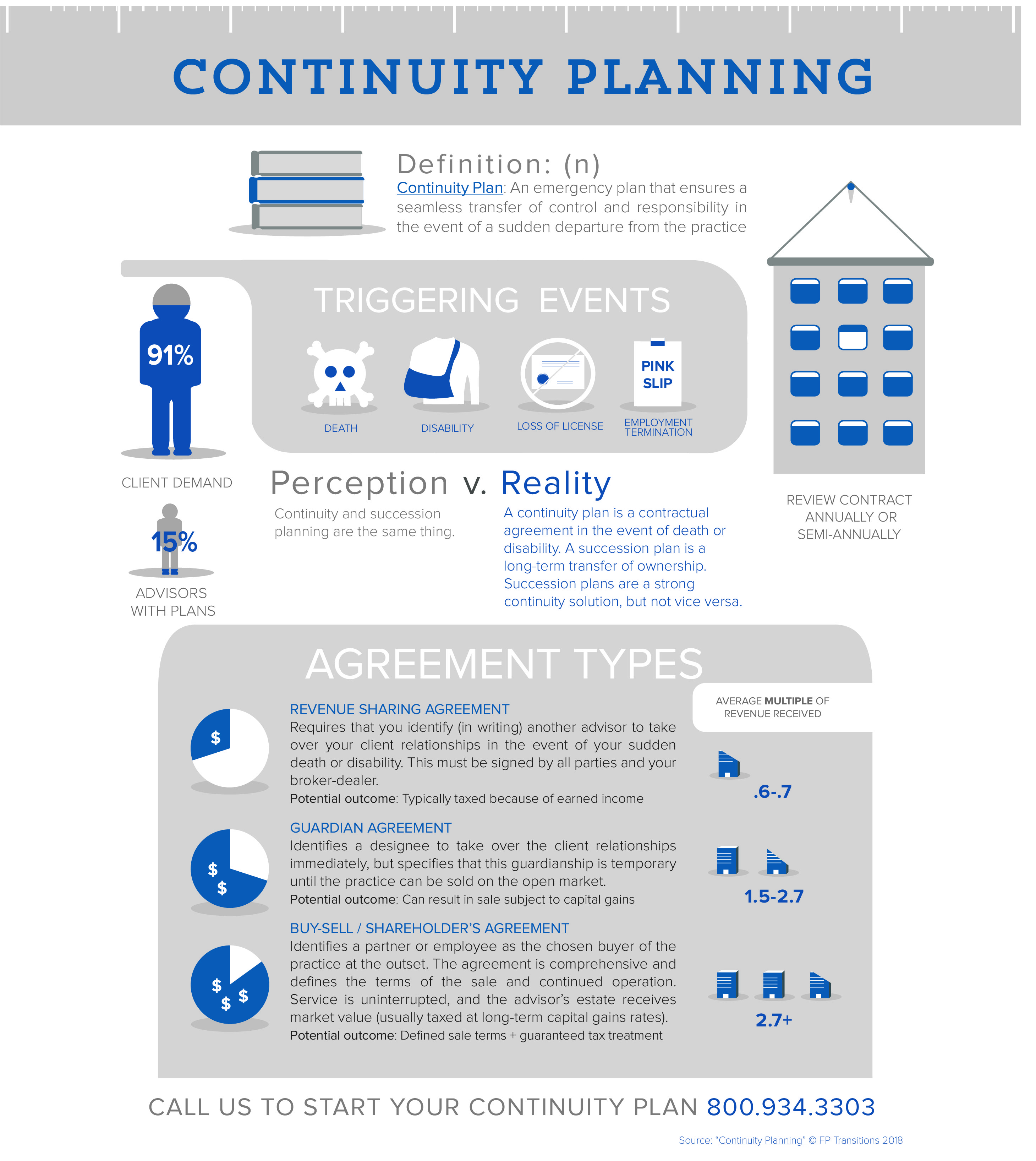

The infographic below breaks down some continuity basics and options.

click to enlarge

Ensure your business is safeguarded against the unexpected. Explore FP Transitions' Continuity Planning services or call 800.934.3303 to update (or establish) your continuity plan.