Blog

Lending for Successors: What Advisors Need to Know

If you are preparing to become the successor of an RIA firm, you may have a lot of questions and concerns about how to negotiate the best deal and what lending options are available to help you finance the succession.

To help you answer these questions, Alicia Chandler, President and Susie McEuen, Strategic Markets Vice President of Oak Street Funding sat down with FP Transitions’ Director of Valuations, Aaron Wells, and CFO, Eric Leeper, to share their insights and tips on what successors need to know.

What to Expect

It's a business loan, not an auto loan. Lending for RIA successors is based on the cash flow and future revenue of the firm, not on the tangible assets. This means lenders will look at financial statements, tax returns, client agreements, valuation reports, and transition plans to assess your ability to repay the loan. You will also need to provide a detailed business plan that outlines your growth strategy and projections.

Available Options

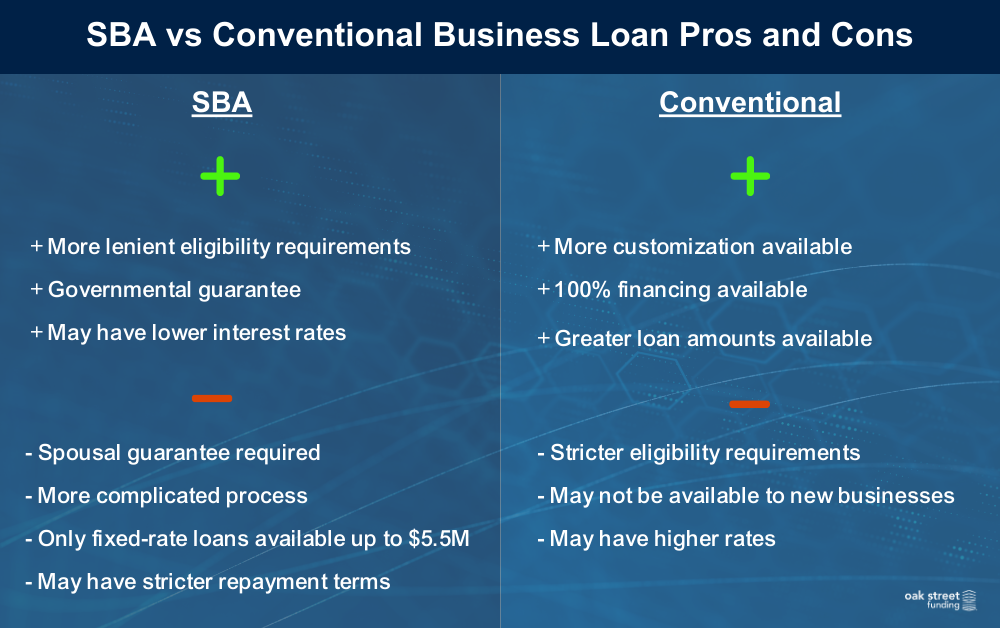

There are two main types of loans available to RIA successors: conventional loans and SBA loans. Conventional loans are offered by banks and other financial institutions, while SBA loans are backed by the Small Business Administration and are available through SBA-approved lenders. Both types of loans have pros and cons, depending on your situation.

Conventional loans tend to offer more flexibility and customization than SBA loans. They can also be faster and easier to obtain than SBA loans, as they have fewer requirements and paperwork. However, conventional loans may have higher credit standards and stricter covenants than SBA loans.

An additional benefit of conventional loans is the possibility of 100% financing. Unlike other industries, where lenders typically require a down payment of 10% to 20%, RIA successors can obtain up to 100% financing for their deals. However, 100% financing is not guaranteed and depends on various factors, such as the size and quality of the deal, the creditworthiness of the borrower, and the terms and conditions of the loan.

SBA loans tend to offer more protection and security than conventional loans. They have lower credit standards than conventional loans and have a government guarantee that reduces the risk for lenders. However, SBA loans can also be slower and more difficult to obtain than conventional loans, as they have more requirements and paperwork.

Which type of loan is right for you?

The best type of loan for you will depend on your individual circumstances. If you have a strong financial profile and can qualify for a conventional loan, you may be able to get a lower interest rate. However, if you have a less-than-perfect financial profile, an SBA loan may be a better option.

What Lenders Evaluate

When evaluating a loan application, lenders take into consideration at a number of factors, including:

• The financial health of the RIA firm

• The value of the firm

• The experience and qualifications of the successor

• The loan characteristics

The Process

The process to get a conventional succession loan typically has six steps.

1. Assessment – the lender will discuss your unique business needs and ensure all your questions are answered.

2. Application – you will submit initial documentation to assess whether a term sheet – a non-binding letter of intent which summarizes the important financial and legal terms as well as the amount of the loan and its repayment – can be issued.

3. Processing – following execution of a term sheet and deposit, you must submit all documentation required for a loan.

4. Review – all relevant documents and information are analyzed by Underwriting, and any outstanding questions are addressed.

5. Closing – final review and signing of the loan documents.

6. Funding – funds are disbursed.

Additional Tips

Get organized. Gather all of the necessary financial information about your practice, such as financial statements, tax returns, and pro-forma financials that forecast the expected future revenue.

Be transparent. The more information you provide upfront, the easier it will be to secure financing and avoid surprises later on.

Engage professionals to help you through the transaction. You should work with a consultant such as FP Transitions, an attorney, an accountant, and a lender such as Oak Street Funding who understand the RIA industry and can help you structure the deal in a way that meets your goals and protects your interests.

Listen to the full conversation with experts from FP Transitions and Oak Street Funding here.

Disclaimer: Please note, Oak Street Funding does not provide legal or tax advice. This blog is for informational purposes only. It is not a statement of fact or recommendation, does not constitute an offer for a loan, professional or legal or tax advice or legal opinion and should not be used as a substitute for obtaining valuation services or professional, legal or tax advice.