Blog

Technology and Value

Advisors constantly seek an answer to the questions “How can I grow faster?” and “How can I increase the value of my practice?” Generally, their focus is on acquisition. However, growth and value are not singular concepts. In other words, achieving a rapid pace of growth needs to be tackled through multiple facets, and ultimately, growth will be a driver of value. However, many practices are not adequately equipped to grow at the rates they are striving for. Technology provides many of these opportunities. Investing in technology has a demonstrated relationship to higher growth, more affluent clients, increased profits, and increased value.

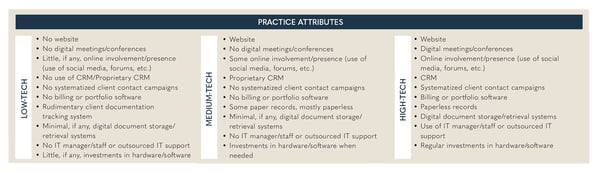

The rapid pace of technological advancement has provided financial advisors more opportunities to reach a broader client base and manage client relationships more effectively and efficiently. By implementing and effectively utilizing web-based advertising, digital conference rooms, client relationship management (CRM) systems, and billing and portfolio management software, advisory practices of all sizes are able to more closely track their performance and focus their efforts on the market segments they wish to target.

click to enlarge Tech Level Attributes Table

Investments in technology in and of itself will not add to the value of the firm. Use of technology requires investments of time and money to strategize how the technology can be most effectively utilized in the course of business. Technology is a means to an end where, as the data below suggests, an increased online presence, coupled with a non-proprietary CRM system and billing and portfolio software tend to result in higher revenue growth rates, better client management, and, ultimately, higher values.

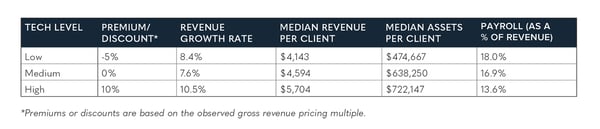

Our data suggests that low-tech practices, on average, sell for less as compared to high-tech businesses. The value delta between these types of practices has been observed to be as high as 15%. One reason for this is that low-tech practices often struggle to gather basic information about their practice and client base.

Interestingly, higher-tech practices consistently report servicing fewer, but more affluent, clients when compared to similarly sized low-tech practices. While somewhat counterintuitive, effective use of CRMs and other client servicing technology allows for businesses to actively manage their client base and focus their time and resources on more profitable clients.

Servicing fewer, more affluent clients allows other efficiencies to be gained, including the ability to increase profitability. The largest expense for most, if not all, advisory businesses is payroll. By successfully incorporating technology into an advisory business and utilizing a CRM to track and monitor client contact and systematize certain other forms of communication, practices are able to strategically grow their bottom line. On average, high-tech practices, report lower payroll expenses, as a percentage of their total revenue when compared to low-tech practices.

Regular investments of time and money in technology can pay off in the long run. Having an online presence and embracing digital meetings and conferences can increase a practice’s market share and assist in servicing clients in other states and regions. Use of a CRM can help advisors stay on top of important tasks, provide reminders to follow up with specific clients at specific times, and offers a central location to store notes about each client. Cumulatively, strategically—and effectively—utilized technology can unlock a practice’s growth potential and profitability.