Blog

Closing the Succession Gap

In many professions and in most businesses, succession planning and sustainability are not pressing issues. Most people don’t need a multi-generational dentist office, for instance. Who really cares if the neighborhood hamburger stand or your favorite restaurant has a succession plan? But in the financial services and wealth management industry it’s different.

Advisory clients have a clear–and not unreasonable–expectation of receiving continuing advice and investment management tailored to the length of their lives, not to the length of their advisor’s career. Being an independent financial professional necessarily indicates a commitment to the future; the element of planning implies that a financial advisor is starting something that will not and should not end with his or her own career.

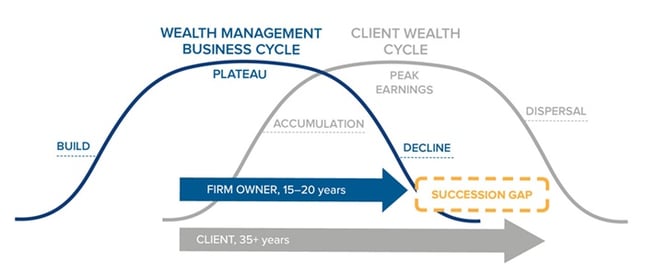

Consider the average successful financial advisor is in his or her mid-50’s. At that age, the owner/advisor will likely continue to work for another 15 to 20 years, even as time in the office gradually diminishes over the last half of that plan. At this time, clients are transitioning into retirement and are likely to need more financial guidance, not less. The term “succession gap” refers to the time difference between a single financial advisor’s career length and a client’s wealth cycle.

click to enlarge graphic

The result of the succession gap is not only poor for the client base, it is also poor for the business, because it ignores 15 to 20 years of client needs, responsibilities, and management. This revenue stream, its value, and the attendant duties could be easily passed on to the next generation of ownership if a succession plan was established earlier in the process. It only makes sense to design a wealth management business cycle that addresses the client wealth cycle.

That is the role of succession planning – to build a sustainable business with multiple generations of ownership.

For many independent advisors, succession planning is becoming the cornerstone to a strategic growth strategy designed to perpetuate their business and their income streams beyond their own lifetime. This makes succession planning one of the most, if not the most, important practice management tools in this industry today.