Blog

Recap of the FPT 2022 M&A Market Update

Our summary of the independent advisory M&A market, including a look at real transaction data, context to help advisors understand what's driving the data, and an unbiased look at what's really going on out there.

2022 M&A Market Update:Brad Bueermann, CEO & Principal

James Fisher, JD, Vice President of Mergers and Acquisitions

March 15, 2022, marked our third annual M&A Market Update for the independent advisory market. With an eclectic and unfiltered mix of market updates in the wealth management space today, advisors have an understandably difficult and confusing time sorting through what’s real. We take our data, and our responsibility to the independent marketplace, seriously. We diligently comb through stacks of data each year to bring our audience a sound and transparent picture of what is truly happening in our market.

Our take on key questions surrounding hot button issues like multiples, equity transfers, valuations, and deal terms are rooted in experience and bound by context. Because we serve clients across the wealth management spectrum, our view of the marketplace is likely broader than what is reported in the news regarding mergers and acquisitions by private equity roll-ups and aggregators. However, we are not immune to the impact that these influencers have had on the market. Simply put, the entire market is affected by such deals, amounting to skyrocketing valuations and emboldened transaction frequency. But what does all this mean for the traditional independent advisor, or insurance and wealth manager, seeking a valuation for any number of reasons (continuity, succession, merger, acquisition, equity transfer)?

That’s what has been missing from the mass media coverage this year. Just like you, we want the unmasked truth around what’s happening in the majority of the advisor M&A market. While it’s interesting to hear of billion-dollar valuations and hundred-million-dollar acquisitions by the biggest market players, it doesn’t paint a realistic picture. Those deals comprise less than 10% of the total advisor M&A market. And remember, this market is impacted by both MERGERS and ACQUISITIONS. As you'll see in our data, mergers happen very frequently in the independent advisor space, and they are not slowing down.

2021 MARKET DATA

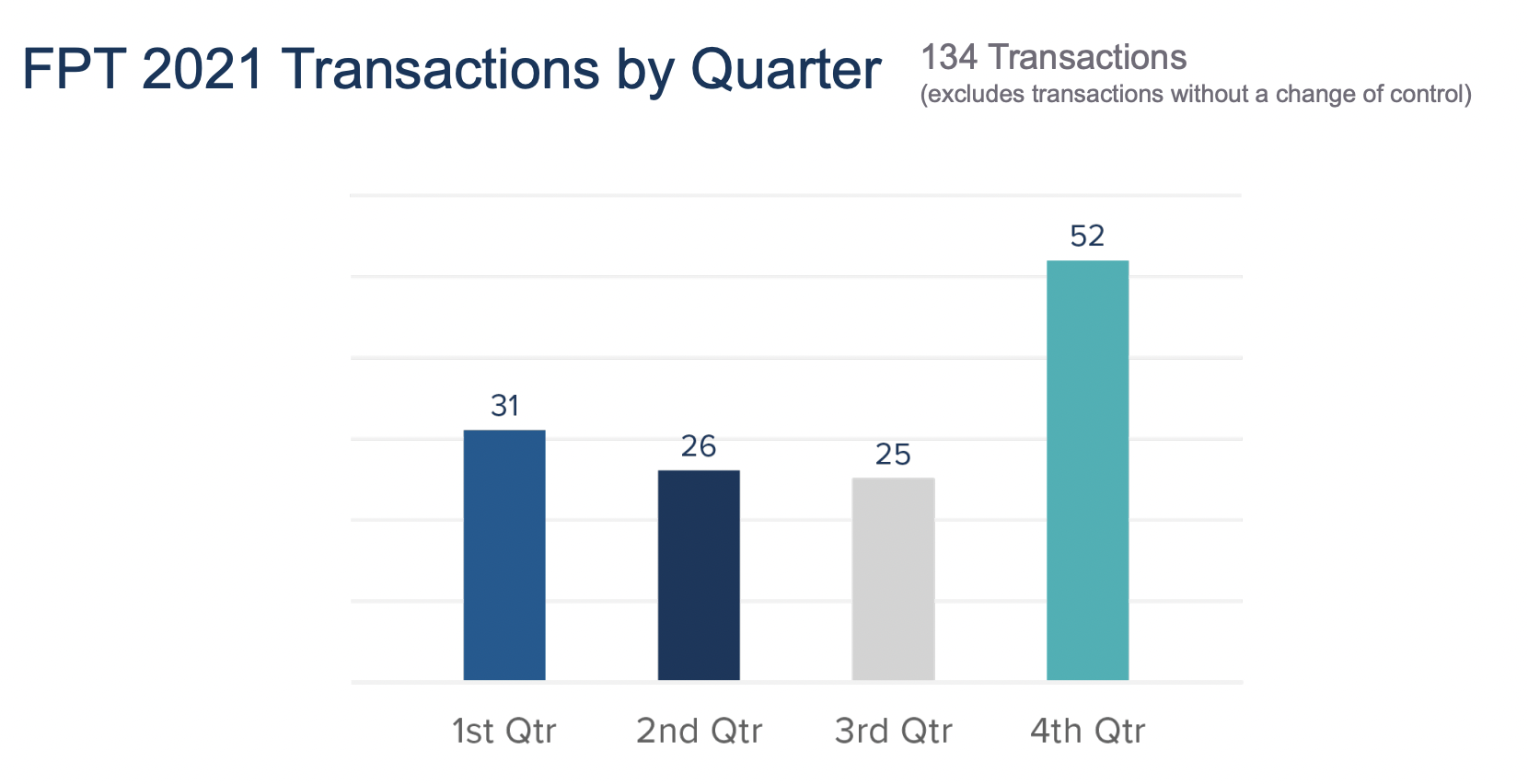

2021 was an incredible year for the entire M&A market, not just for us at FP Transitions. Everyone experienced a surge of activity and an increasing demand for acquisitions. Looking at the number of deals done by quarter just at FP Transitions, you can see activity increased substantially in Q4. Contributing to this spike is a traditional push for closing deals before year-end.

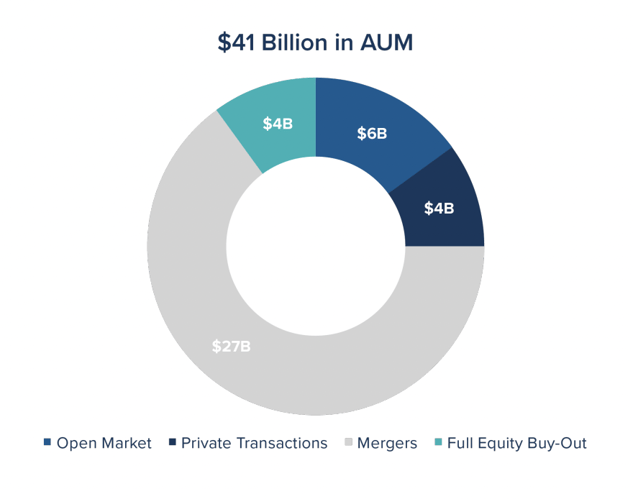

Our team completed a total of 134 transactions (only counting equity transactions where there was a change of control), facilitating the transfer of over $41 Billion in AUM, and more than one quarter billion in revenues. We believe our 134 transactions represent about 10% of the total number of advisor M&A transactions that occurred in 2021.

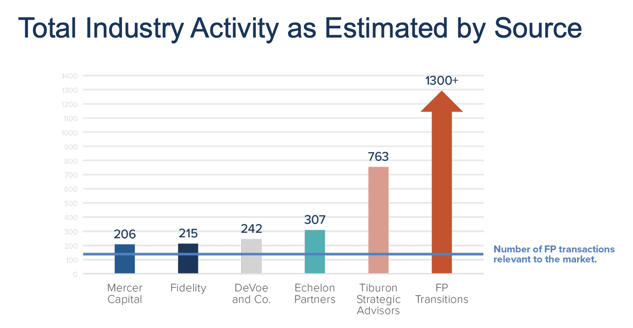

This is where many advisors may be confused. Data reported in the media paints a starkly different landscape, quoting anywhere from 200-300 deals completed in 2021. But according to another source, over 750 deals occurred last year. To put this into perspective, FP Transitions, and our many enterprise partners, believe this number to be significantly higher, perhaps north of 1,300 deals transacted in 2021.

There are four types of transactions contributing to the overall $41B AUM number: open market (14.6%), private transactions (9.75%), mergers (65.9%), and full equity buy-out (9.75%).

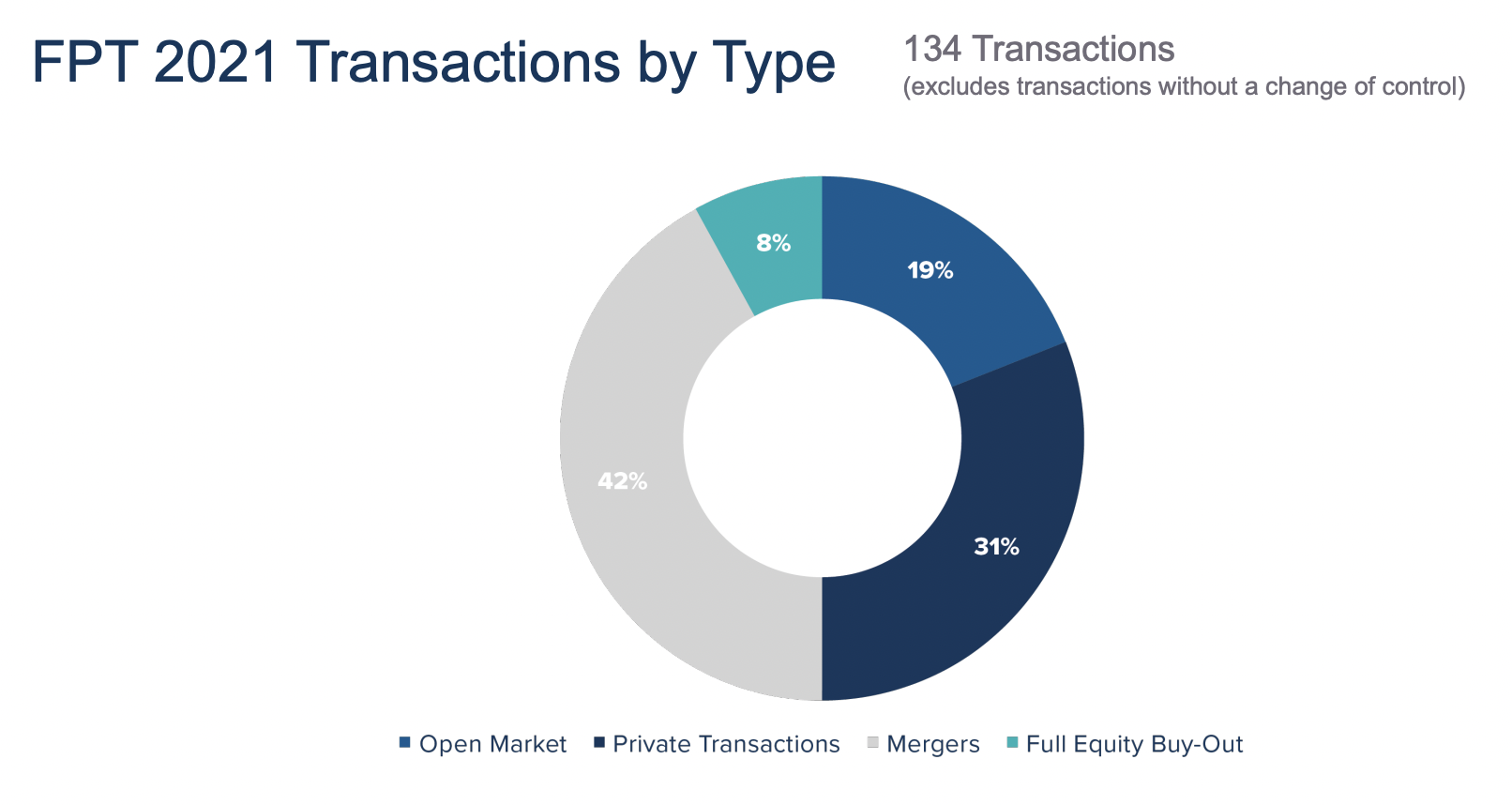

When you break down the 134 transactions, you get a slightly more interesting picture. Full equity buy-outs (when a minority partner purchases the majority ownership of that firm) represented 8% of the total FPT deals. Many of these transactions were the result of a next generation advisor buying out their principal owner and taking on that ownership role.

Now looking at mergers (when two interesting businesses come together to form a much stronger, more sustainable business entity), these represented a large portion of the $41B AUM transfer, and 42% of the total deals completed by FPT in 2021.

Considering the impact of both mergers and equity buy-outs on the overall number of deals transacted, we’re looking at 50% of the total deals completed in 2021!

One reason for a discrepancy in what’s reported and newsworthy is that discretion remains crucial for many firms throughout their deal process. Consider the factors at play. Private transactions are typically private: most firms completing an acquisition or merger are focused on integrating their acquiring or merging partner into the firm. They are focused primarily on seamless transitions in technology, staff, and client relationships. These are slow transitions that require discretion, quality of care, and avoiding any level of disruption where possible.

What Drives Deal Discretion? Avoiding:

- Disruption to client relationships

- Unsettling staff

- Alerting competitors in a talent drought

As a result of only tracking large, powerhouse acquisitions, advisors see a very narrow market perspective. This distorts reality by projecting that there are only a handful of qualified buyers in the marketplace. In direct contrast, of the 134 transactions FPT completed in 2021, the majority of these deals were completed with entirely different companies, most of whom were completing their first ever transaction.

One major misconception is that aggregation is large firms 'gobbling up' smaller firms. “…and that’s simply not what we’re seeing on the ground,” shares Brad Bueermann, Principal and CEO of FP Transitions. “The average deal is over $1B? When you look at the data, it just doesn’t make any sense.”

WHAT WE'RE SEEING:

- Smaller firms are becoming medium-sized firms

- Aggregators are picking up opportunities at a healthy pace

- Ideal merger partners exist for firms in the $250M - $750M space

- There are thousands of buyers in the marketplace

- EBITDA multiples are on the rise, but they don’t tell the whole story

EBITDA MULTIPLES

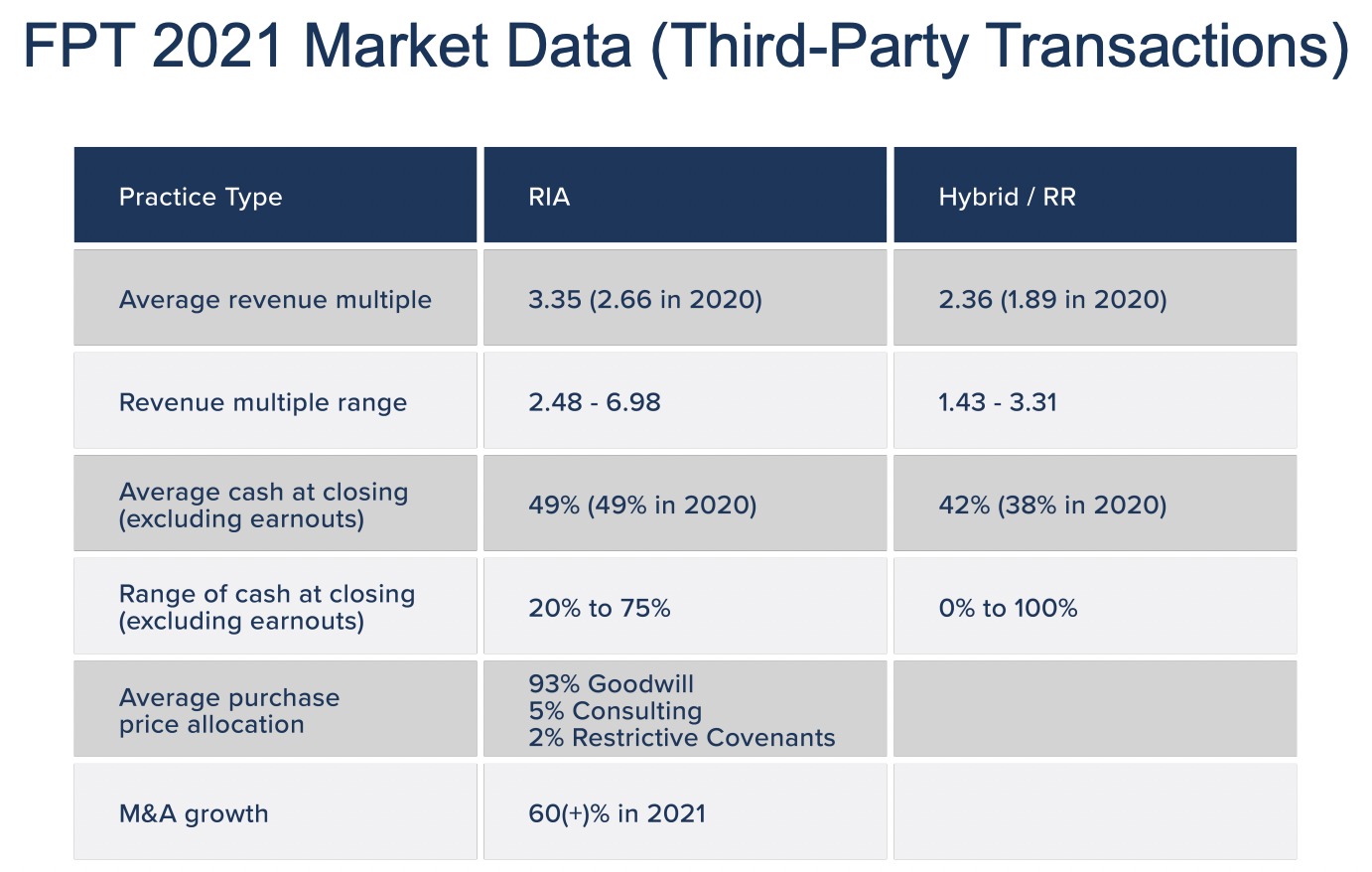

While a very helpful tool, relying on EBITDA as a benchmark to determine value in the open market is a flawed approach. According to James Fisher, Vice President of Mergers and Acquisitions at FP Transitions, “EBITDA multiples really need a decoder that only people involved in the transaction have access to.” It is a highly manipulatable number, and it depends on your buying or merging partner. What really impacts value and price are the deal terms. We have seen some instances where a buyer is willing to share synergies from technology and compensation, essentially giving credit for staff members that they were bringing over in the merger, who they knew to be redundant. Simply put: the devil is in the deal terms. The fact pattern matters. Contingencies, credits, compensation, all of these elements impact the final price. It’s important to understand the details and deal terms of a transaction when analyzing the EBITDA receipt.

What can you rely on? Averages and real data can give a baseline, but your business value requires a far more comprehensive and expert guide to navigate the optimal deal terms for your scenario.

OPEN MARKET TRANSACTION DATA

IN CONCLUSION

One compelling storyline rising out of the 2021 transaction activity is the reality that many more firms are looking to fortify their practice through sound business principles. They are embracing strategic planning best practices like internal succession and transition planning and are proactively managing their business value. Lifestyle practices are thriving as we see many more Sell and Stay® scenarios coming together through mergers and equity transfers. An aging advisor demographic continues to build ownership pathways and spread-out equity within the firm to attract and retain talent. And while EBITDA multiples are on the rise, the contributing factor isn’t just ‘market activity.’ These are the result, in many cases, of increasing profitability as firms diversify their offerings, build sustainable business lines, invest in efficient technology, and continue to attract and retain top talent to meet the demands of healthy client growth.

If you aren’t sure of your current value or want to learn more about building a healthy and sustainable business, check out our Equity Management Solutions®. We help over 2,000 businesses achieve their growth and profitability goals each year. Many of these firms have succession, merger, and acquisition goals that are realized through their partnership with FP Transitions. There is no single way to approach your business trajectory. Your journey is personal; it’s unique to you. We honor that in our consulting services, and our team is ready to tackle any challenge you throw our way.

>>> Learn more. <<<

About FP Transitions

FP Transitions is the nation's preeminent consulting firm dedicated to wealth managers and independent financial advisors. We guide over 2,000 firms each year through M&A, business valuations, consulting, and our proprietary Equity Management Solutions® program. We offer the industry’s most thorough benchmarking data spanning more than 15,000 certified valuations, backed by a team of nearly 60 credentialed analysts, lawyers, and consultants. Dedicated to the advancement and sustainability of the wealth management industry, FP Transitions transforms practices into thriving businesses through proper entity structure, intelligent compensation design, and equity pathways that allow a smooth transition of ownership while increasing firm value. Over the past twenty years, FP Transitions has pioneered and revolutionized our industry’s premier succession and transition planning strategies and houses a full-service legal department that has completed more advisory M&A transactions than any other investment banker or business broker in the country.

For media inquiries, contact:

Elise Rogers, VP of Marketing