Blog

Preparing for the Next Tranche in Your Succession Plan

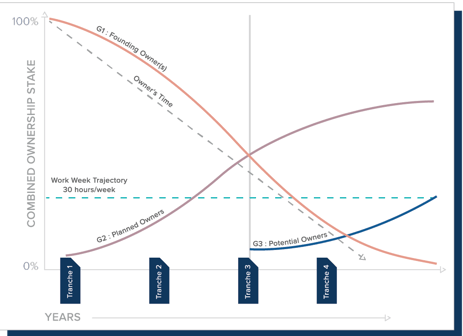

Your firm’s succession plan is designed to gradually transition ownership, leadership, and growth responsibilities to the next generation of advisors. The goal is sustainability of the firm, and it is accomplished through a plan that coordinates the changing roles of the founder(s) and the successor team over many years.

Selling equity in the business in a series of steps or “Tranches” gives both the founder and the next generation of owners the time to wisely manage the transition and to prepare for the changes to come. The transfer of ownership from the founders (G1s), to the second and third generation of owners (G2s and G3s), starts with Tranche 1. Tranche 1 is usually a sale of 10% to 20% of ownership to the next generation. Tranche 1 is often called the incubator stage and allows for all parties to test the waters and to prepare the business structure for the journey ahead.

TRANCHE: Tranche is a French word meaning slice or portion; it's the term used for each sale of shares.

The second step, Tranche 2, can include another sale of 10% to 20%with G1 retaining the majority ownership position. How much equity and how often will depend on the timeline of G1 - if G1 is exiting in thirty years they can sell shares more slowly than an advisor with a 6 year timeline. The tranche system – selling to G2s and eventually G3s – not only widens the ownership base but also provides a strong continuity plan in the case of a death or disability..

As our clients progress through Tranche 1 we are often asked, “When should we start Tranche 2?” And the answer is: “It depends..

Every situation, every firm, and every person is different. Not everyone in Tranche 1 may move into Tranche 2. And, the percentage of ownership sold and the deal terms do not have to be the same from tranche to tranche. However, one thing is vital – the readiness of the G1s, the G2s, and of the business itself; all need to be in alignment for the plan to be successful.

The best way to ensure this alignment is achieved over the course of the first Tranche is to support open communications and the free flow of accurate, reliable information. Day-to-day conversations and regular meetings to review the firm’s progress, as well as the new owners’ progress, are key.

As you set goals and plan for the next Tranche, here are some considerations for each party’s unique position and role in the plan.

G1s – The Founders

The second buy-in is key because this is where G2 starts to shoulder more risk and responsibility.

HOURS: A decrease in ownership percentage should correlate with a decrease in overall hours worked (part of preparing G2/G3’s to take over one day). You may decide to take Fridays off, or to take off one week a month. This is a good opportunity to see how the firm runs with the G2s in place and to help them hone their skills as owners. If you are not getting calls from work while you are away and come back to a well-running office and happy clients, that’s obviously a good sign.

TRAINING: You will want to nurture the G2’s growth and monitor their progress. Take the time to show them the ropes and give them the opportunity to make mistakes in a safe environment. Watch how they handle those mistakes and how they face challenges and use those as teaching opportunities.

TIMING: Think about your exit timeline– it may be over a decade on the horizon–it may be within the next few years. Either way, you’ll need to consider the pace of the succession plan and adjust gradually to ensure alignment with your long-term financial and transition goals. Goals change and the tranches of your plan can and should be adjusted accordingly, overlapping the tranches or accelerating the plan depending on the situation.

FINANCES: Assess your personal and business finances and how they factor into your succession plan. How much longer would you like to work? Are you enjoying having business partners and next generation owners to work with? What does retirement mean to you? This is a conversation that should include a spouse and might include other family members. Consider how you may need to adjust financing for subsequent tranches to meet your personal income goals. Later in this article we’ll highlight some alternatives to the seller-financed soft note that will support diversified risk and liquidity.

MENTAL READINESS: Think ahead. What do you want to do next? Whether you plan to one day leave the business entirely, or to stay on in an advisory role, if you have post-work plans in mind, the ongoing transfer of ownership, leadership and management will be easier for you.

G2s and G3s – The Next Generation

For next generation owners, as you continue along the ownership path, roles will shift – you may earn a new title, your workload will most likely increase, G1s responsibilities will gradually become yours. You’ll also be earning money based on the profitability of the company and will have a say in shaping the future of the business.

RESPONSIBILITY: With your increase in ownership, there will be an increase in responsibilities. This could include management of other staff, input on business decisions and bringing new ideas to the table. Regular performance reviews provide an opportunity to gauge your progress – both for you and your fellow owners. Consider also how you are personally handling the added responsibilities. Be sure you are up for putting in the time necessary to grow and improve the business, and to accommodate G1’s gradually diminishing role.

PRODUCTION: Take time to review production goals – your own and those of the business as a whole. Are they still appropriate given the length of the anticipated succession plan, the level of profitability, and the financial needs of the ownership team? Look to see if goals are being met, exceeded, or missed. Look ahead to how your goals will evolve as you take on more responsibility and ownership stake.

SKILLS/PROFESSIONAL GROWTH: It is important to consider the skills you are acquiring over the years of the first tranche of ownership. How has your product knowledge improved? Are you comfortable reading the business’ financial statements? Continuing Education, extra courses, and new designations are all signs of growth. But don’t discount the development of soft skills such as the ability to lead meetings with clients, recruit and train new talent, and, even gain an understanding of conflict management skills for when staff members don’t work well together.

PERSONAL GOALS: As Tranche 1 progresses, it is important to ensure that ownership in the firm is adequately supporting your business, family, and personal goals. Do you want to earn more money? Do you want better control of your time and work week demands? Do you aspire to more ownership and control? Continue to communicate your goals and needs with the stakeholders as business and financial goals–and risks–change with increased ownership.

RISK: For some people, an investment in the firm is an exciting opportunity to contribute their passion to something they can help grow and which can provide a substantial financial reward. There is risk associated with such an investment, and not everyone may be ready to increase their risk exposure. Each tranche tends to gradually increase the level of risk on G2/G3 advisors, so take the time to ask questions and learn more about the process.

VISION: If you haven’t already, share with the founders what you see as the future of the business, and the industry. Consider every aspect of the business including: regulatory structure, entity structure, the ownership team, staffing, compensation, office location, and competition. Often new owners revitalize and reenergize the firm. Let your enthusiasm and passion shine through as an important member of the ownership team. In ten years, this is likely to be a very different business so it is best to think this through and prepare well ahead of time.

OWNERSHIP MENTALITY: Consider how you (both producers and non-producers alike) have worked to decrease expenses and increase revenue in the business. Have you considered a new technology, helped diversify the income stream, tightened up daily procedures, or maybe helped the company go green? Strategies to reduce overhead and improve operations show a commitment to the bottom line and overall growth of the business – all part of being an owner.

The Business – The Multi-Generational Firm You Are Creating Together

Transferring a business takes a lot of planning, hard work, and continual adjustment. As G1 and G2 owners collectively prepare for the next tranche, take time to review the business itself.

GROWTH: Check the overall health of the company. Refer to your annual valuation and benchmarking reports to analyze growth in revenue, AUM, and clients. Consider whether your growth supports moving forward with the next tranche.

CLIENTS: As more responsibilities are shifting to G2s, look to see how the clients are accepting the new roles of the next generation advisors. Introduce younger advisors into client meetings, if you haven’t already. Allow them to take the lead on certain projects to boost visibility and client trust.

LONG-TERM VISION: Are there intended G3s in the picture? Consider starting ownership discussions with them. Ideally, they have witnessed the G2’s successes (and challenges) and may be ready to step up to the plate. If there are no G3 candidates on your team yet, it could be time for the G2s to make the search for G3s a priority.

Financing

When considering Tranche 2, understand that you are not limited to the same type of financing used in Tranche 1 – which is most often a seller (G1) financed, profit-based soft note with a stock pledge as collateral. G2 pays back the note using the profit distributions they receive.

Some Tranche 2 sales use switch to fixed payments usually every month or quarter. This is less risky for the lender. Another option is bank financing which is becoming increasingly available for internal share purchases. And, when it comes time for the G1 to fully exit the business, SBA lending can be used to for a full buyout of the founding owner

https://www.fptransitions.com/blog/lending-for-successors-what-advisors-need-to-know

Moving Forward

The overall goal of your succession plan is to create a multi-generational, sustainable firm that will continue to care for generations of clients. The tranche system allows for the gradual, incremental transfer of ownership, and preserves the room to assess and adjust the overall plan as needed. Not every next generation owner will move from Tranche 1 to Tranche 2, and that's OK. People's lives and goals change. Regular communication between the owners, future owners, and other key employees allows for continual evolution of the plan and the best chance for success.